John Tuason, Government and Politics reporter

Jonathan Lopez is a father and husband. He currently pays ~$360 a month for a silver health insurance policy and qualifies for Cost Sharing Reductions (CSR) bringing his deductible down to $800. Expiring Affordable Care Act (ACA) subsidies mean that starting on January first, Jon’s monthly payments could increase 2-3x and he explained to me that, “If our premiums double next year, there is no way I will be able to pay it. We’re gonna have to get on a bronze plan and my daughter’s diabetes ‘ll burn a hole in my pocket.”

Lucia Martinez is a wife and mother of two. Her husband receives coverage through his job (employer-sponsored insurance), Lucia and her two sons pay ~$900 a month. In January, her monthly payments could jump up to ~$1100 a month. Lucia’s family is planning to move. “We were downsizing anyways, but these increases are limiting our options.”

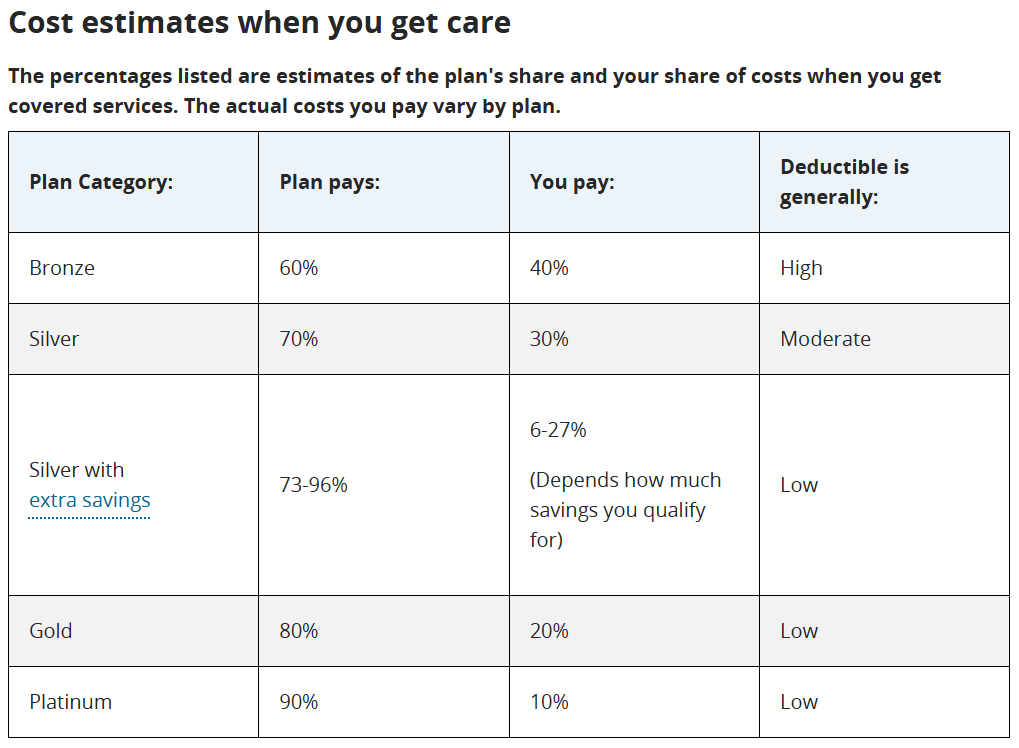

Deductible: The amount you pay for covered health care services before your insurance plan starts to pay.

The ACA was enacted in March of 2010 to expand Medicaid and to make health insurance more affordable for households with incomes between 100-400% of Federal Poverty Level (FPL). The American Rescue Plan (ARP) Act of 2021 temporarily enhanced ACA subsidies, lowering premiums for many families and broadening health coverage in general. The ARP was one of the government’s attempts to ease the hardships facing Americans during the COVID-19 pandemic. After December 31, 2025 these enhanced subsidies are set to expire.

This impending expiration was the cause of the longest government shutdown in US history. Senate Democrats blocked the continuing resolution passed by the Republican-controlled House of Representatives because it lacked the extension to the subsidies. Eight senate democrats broke ranks with their party and voted to pass the funding bill and in return Republicans made a promise to hold a vote in December to extend the subsidies.

Natalie Cooke, a professor of Public Health at Virginia Tech, explained how these expirations will affect American families. “It’s the families whose health insurance is solely through the marketplace who will get hit the hardest… The lower- and middle-income households who rely on marketplace coverage are going to see their premiums increase by like 2 times which is very significant especially when they are already having to deal with inflation and rising costs.”

On December 11, 2025, two bills were proposed in the senate to address expirations. Democrats, led by the Senate Democrat leader, Chuck Schumer, proposed a bill containing a 3-year extension to the enhanced subsidies. The congressional budget office estimated that this proposal would add $83 billion to the federal deficit over the next decade. Republicans argued that it did not address the “…billions of dollars of fraudulent spending” as Senator Bill Cassidy stated.

Republicans, on the other hand, wanted to do away with the enhanced subsidies and create Health Savings Accounts (HSA). This proposal stated that individuals receiving under 700% FPL between the ages 18-49 would receive $1000 in HSA funding while individuals between 50-64 would receive $1500. They argued that this method would stop payments to insurance companies. Democrats opposed this proposal because it did not address the premiums and because it included restrictions on abortion and gender affirming care.

Both the democratic and republican proposals have failed to reach the required 60 votes to pass the senate. Now, there are only a few days left for lawmakers to address the expiration. “It is hard to see how a bill can come together — and pass — by this time next week, which is when Congress is set to leave for the year so we will start 2026 with the threat of a government shutdown at the end of January having failed to address the core issue of the 43-day shutdown: the ACA subsidies/credits,” Chris Krueger, a strategist at Washington Research Group, wrote in a research note on Thursday.

Meanwhile, people like Jonathan are having to make drastic spending cuts to prepare for the changes. “I mean it’s Christmas and I want to make sure my daughter gets what she wants first, but we can’t just pray that our premiums stay the same y’know? We’ve gotta think longer term which really f—- me up” he said.

Since 2021, the number of Americans enrolled in the marketplace has gone from 12 million to almost 25 million. This is due to the enhanced subsidies that ARP has offered. Virginia has seen a 100,000 person increase in the same 4-year period. The middle-income families making around 400% of FPL are going to face what is known as a “subsidy cliff.”

…22% of their income.

“Historically, the 400% mark is where we see this subsidy cliff. Before the enhancements during covid, someone making 390% ($50,000) would pay about 9 to 10% of their income for coverage. If that same person were to make 410% ($52,000) they would have to pay the full premium which on average, for a silver plan, is like $960 a month or 22% of their income,” said Cooke.

The subsidy cliff was eased by the enhancements offered by the ARP and the expirations will bring that cliff back in a dramatic way. This will result in an average increase of 114% in premium payments according to the Kaiser Family Foundation, but it is families like Lucia’s who are going to feel it the most.

…a year of uncertainty for the average American.

Opinion:

The expiration of these subsidies is being wielded as a political weapon by both democrats and republicans and exhibits more broadly how the partisan stalemate we see in congress is gambling with American’s lives. Our systems of governance are showing cracks, and it is the people that rely on it most that are going to suffer the most. Bipartisan collaboration is necessary if we want to protect the most vulnerable Americans which should be the goal of every elected official.

According to the Yale Program on Climate Change Communication, in a poll conducted on May 15th of 2025, the top worries of Americans are 1. The economy 2. The cost of living 3. Government corruption 4. The state of democracy in the United States. All these concerns express both an affordability crisis and a general lack of trust in governmental institutions. These issues, in combination with the upcoming challenges facing affordable healthcare are making 2026 look like a year of uncertainty for the average American.

Preparation is key. Open enrollment begins on December 19th and ends January 30th in Virginia. Check coverage options at www.marketplace.virginia.gov or healthcare.gov because as Jonathan puts it, “…we can only do so much, but we gotta do that much.”