By Janae Neely, Education reporter

The bold “Congratulations!” and confetti bursting from a college acceptance letter evoke feelings of exhilaration, pride, and the promise of endless opportunities. However, for first-generation students, those initial feelings quickly fade as they are faced with an overwhelming question; how are they going to pay for it?

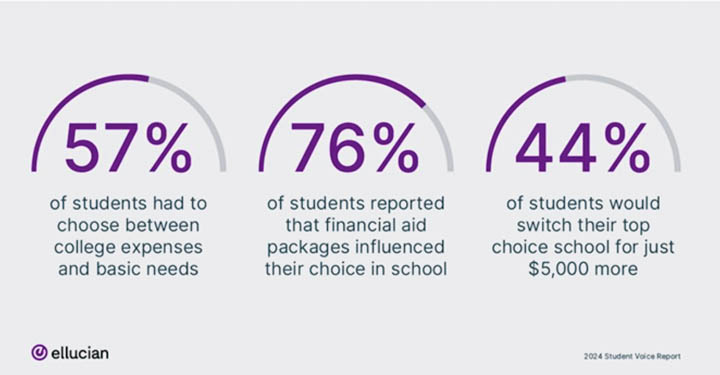

According to a 2024 study, the average cost of college tuition has risen 141% over the last 20 years. And while resources such as student loans and grants are available, those systems can be faulty and don’t succeed in helping first-generation students. Citizens and Everfi reported, “51% of first-generation students said they were nervous about paying for college” and 11% of students said that the price of college wasn’t worth it.

Over 6,000 first-generation students have found a home at Virginia Tech, and the university has taken strides to make sure that first-generation students have easy access to education and resources regarding finances and how to pay for higher education.

GenerationOne, a living-learning community created solely to provide a support system for first-generation college students, held an event this Thursday called Thinkful Thursday: Being Fruitful with Your Finances/FAFSA. This event, hosted in collaboration with Virginia Tech’s Financial Aid Office, educated students on the federal student loan process and provided tips on how first-generation students can manage their finances over the next four years. Hannah Banks, a sophomore at Virginia Tech and a Student Leader in GenerationOne is extremely familiar with the stresses of the financial aid process, “On a scale of one to ten, I would say the stress of financials was a seven when I was deciding where to go to college. Finances were my deciding factor to come to Virginia Tech rather than JMU because they gave me more money.”

Financial Aid Specialist, Diane Roberson headlined the event and gave thorough tips on how to navigate FAFSA, scholarships, grants, and questions from other students on how to navigate the strain of finances on the college experience.

“It’s extremely important to have events like this,” said Banks, “When you’re coming to a large university like this, it is refreshing to be in a community where people have gone through the same experience as you.” A 2022 study conducted by The Ohio State University found, “First-generation students were significantly more likely to use federal student loans, private student loans, money from a job, scholarships/grants, and credit cards to fund their education…” (Rehr et al., 2022). However, the study also showed that first-generation students have less knowledge than their counterparts when it comes to financial literacy and financial self-efficacy. This highlights a clear issue in the education and resources that first-generation students receive.

One of the resources that first-generation students have access to is scholarships. However, only two scholarships out of the 3,000 that Virginia Tech offers are designed for first-generation students. This by far is not enough to help first-generation students with grants and funds. Savannah Stephens, a first-generation senior felt like she didn’t receive the proper education when applying to college, “The FAFSA process was so confusing, and no one in my family had done it before, it was hard trying to find the right information and figure out what to do.” The lack of resources only felt like it continued once Stephens reached Blacksburg, “There were and are plenty of social, emotional, and academic resources but I didn’t need any of those, which wasn’t helpful. I received no financial help as a first-generation student which was extremely stressful at the time.”

In a 2024 article discussing the difficulties of the FAFSA process, the CEO of iMentor, Heather Washington explained, “…I think students are generally sort of frustrated, but I think the real frustration starts to set in, and I think we’re starting to see this with each passing day as the acceptances come in,” Washington continued, “It almost undermines their excitement about getting in and going, because they either haven’t completed the FAFSA, they’re stuck getting it in, or they just submitted it so they know that this acceptance letter isn’t really telling them yet what they can do with this college acceptance that they have” (Anderson, 2024).

In almost every area, first-generation students are starting at a disadvantage. It is constantly an uphill battle that needs to be recognized by universities, advisors, and organizations like FAFSA. There needs to be sectors to help these students so that they can succeed to the best of their ability. Experiences continue to show the significant impact that finances have on first-generation students, highlighting the delicate balance between their success and discouraging them from pursuing higher education altogether. “There is definitely more to be done,” Banks concluded, “ First-generation students still don’t have the resources we need. I think it would be interesting to see a first-generation center where thousands of Virginia Tech students who are first-generation can have access to more resources.”